Tech for improving Financial well-being

Non-credit finance

curating with

manufacturers

- Savings for cash-in/out

- Parametric Insurance

- Pension & liquid Investing

reduce Risk & improve Resilience

Tech tools

for small-businesses

- Digitizing un-organized value chains

- Making it easier for entrepreneurs

- Embedded Tech for power of Data

expand access to finance

Loan variants

based on

consumer cashflows

-

Flexibility on

parameters like

tenors, drawdowns, repayment frequency, collection mode, purpose, amounts

finance Growth to improve Incomes

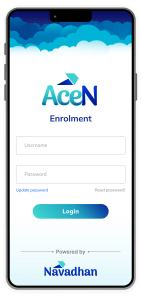

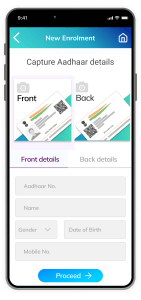

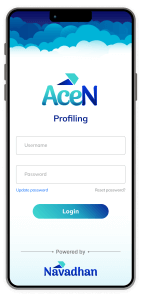

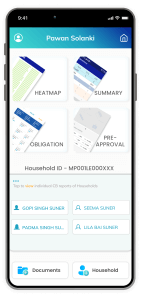

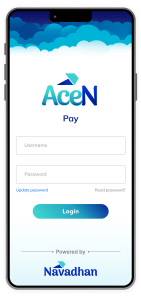

AceN suite of micro-apps

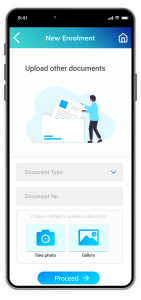

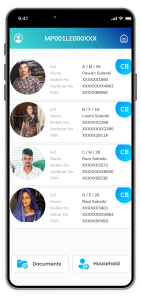

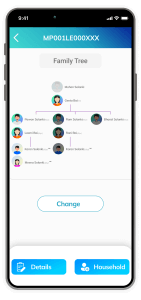

- Customer Enrolment with options of self, assisted & bulk on-boarding

- Profiling based on digital footprint, asset level & cashflows

- Credit Engine based on bureau data scrub, credit parameters & BREs

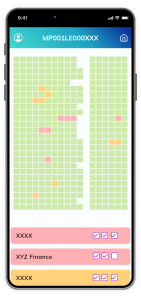

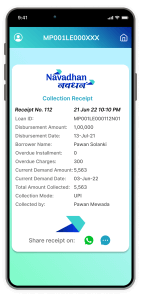

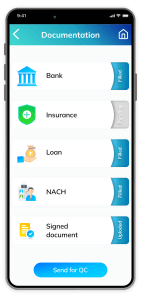

- Payments & collections across UPI, ACH, Cash & other modes

- Consumer Self-service engagement platform with embedded finance

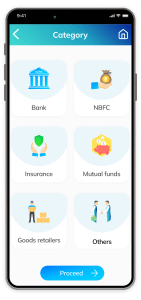

- Partner On-boarding for Banks, NBFCs, Insurer & other service providers

- Partner Allocation Engine matching service offerings with consumers

- Transaction Booking covering legal & banking

- Portfolio Management for reports, analytics, alerts, limit setup

AceN is

set to Digitise, Disrupt and Transform financing of under-banked

Households and Small-businesses in India. It is the most exciting and

futuristic tech-platform coming out of the stable of Navadhan.

Navadhan

Capital Private Limited, an RBI registered Non-Banking Financial

Institution.

Registered Address: 803, Ecostar, Vishveshwar Nagar, Goregaon East,

Mumbai 400063